The Epic Price Hike of TI! Over 60,000 Part Numbers Raised by 10%-30% Collectively

According to multiple confirmations from the industrial chain, this price hike storm covering all product lines has been transmitted to the terminal market through agents, with only a very small number of strategic customers being exempted.

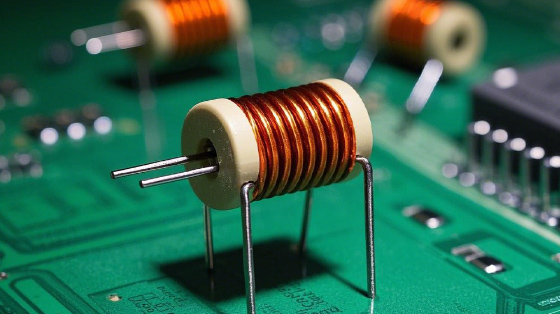

The overall price range has increased by 10%-30% this time, with over 40% of products seeing price hikes exceeding 30%. The focus is on long-cycle application fields such as industrial control and automotive electronics, where key components like digital isolators and isolated driver chips have generally risen by more than 25%.

Notably, unlike the partial adjustment in June that primarily targeted signal chain products, this price adjustment exhibits distinct structural characteristics-by raising the prices of older product models, it aims to guide customers toward adopting new-generation solutions. A typical example shows that the price of a DC-DC converter released in 2018 has increased by 22%, while its alternative model has only been adjusted by a marginal 5%.

From the perspective of product classification, this price increase presents three major characteristics:

1.The industrial control field has become the main battlefield, with more than 40% of industrial control products increasing in price. For example, the unit price of 16-bit ADC chips for factory automation has jumped from $3.2 to $4.1 (+28%).

2.The automotive electronics sector leads in price increases, with significant premiums for automotive-grade products. Isolation chips dedicated to BMS in new energy vehicles have risen by 22%, and power management ICs for in-vehicle infotainment systems have seen price hikes ranging from 18% to 25%.

3.Consumer electronics and communication equipment have seen moderate price adjustments, with power management chips and RF front-end chips increasing by 5%-15%. Notably, TI's second-quarter communication equipment revenue surged 50% year-on-year, and the price adjustment may be closely related to its strategic transformation.

There are multiple reasons behind this price increase. Cost pressure is one of the important factors. Texas Instruments' gross profit margin in China has long been lower than the global average, and rising prices of raw materials (such as high-purity silicon wafers) have prompted it to adjust prices to ease profit pressure.

Although it may affect market share in the short term, it creates opportunities for domestic substitution. Local manufacturers such as Shengbang Co., Ltd. and Sirepo have accelerated the substitution process in industrial and automotive fields. Currently, fluctuations in the spot market are limited, but the industry expects a chain reaction: downstream enterprises may accelerate inventory turnover and optimize supply chain structures, and international manufacturers (such as ADI and Infineon) may follow up with adjustments. TI's move not only optimizes its own profit model but also reflects the strategic transformation of the global semiconductor industry from "scale expansion" to "value creation".